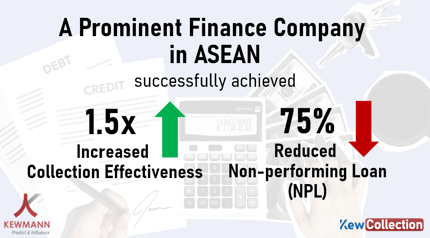

Minimise Default Loss and Risk from Unsecure Loans

Enable your organisations to retain cash flow and reduce non-performing loans (NLPs) with AI-powered debt collection intelligence software that enhances the debt collection process to

- Predict the potential defaulters accurately

- Minimise NPL from unsecure loans by taking immediate action before delinquency starts with an early warning

- Increase operational efficiency with mutually agreed mediation recommendations in only a few minutes

- Influence customer’s behaviours with personalised automated messaging and collection approach by leveraging behavioural science to achieve the desired outcome

Get your Complimentary Discovery Workshop Today!

Simply fill out this form to speak with our debt collection experts.

*For banks and financial services institutions only.

What will you gain from it?

Free access to an online Discovery Session for up to 2 hours with debt collection experts:

|

In-depth insights on how to optimise collection efficiency with AI, Machine Learning, and Behavioural Analytics |

|

Relevant use cases based on your specific scenario, requirements, or industry |

|

A specific customise debt collection optimisation proposal for your organisation **Please request during the session |